Shaw offers a loan and lease solution designed with lease management, insurance, commission and dealer processing, sales tax, property tax and income tax reporting capabilities. The product is suitable for banks, credit unions, automotive finance companies and specialist credit institutions. There are both cloud-based and on-premise deployment options. The solution allows users to track loan details such as issue date, reissue date, debit frequency, and personal identification numbers (PINs). The software also allows users to process different types of loan fees such as new loan fees, enrollment fees, extensions, and termination fees.

SHAW – FEATURES

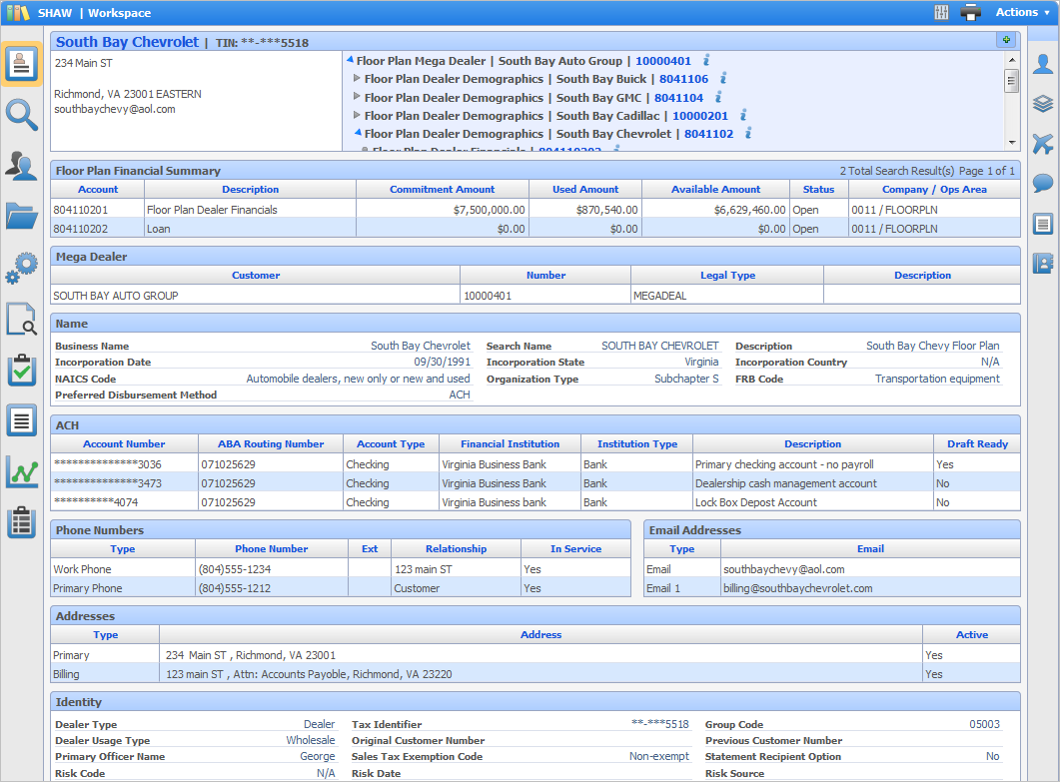

- 360-degree view: customer-centric account management and automated communication campaigns

- Web-based application: modern web-based application streamlines processes and extends data to the digital borrower

- Data-driven technology: make strategic decisions that accelerate success to better serve your customers and staff

- Manage the life cycle: lenders can manage the entire account life cycle in a compliant way while increasing their response time to borrower requests

- Pop-up alerts: real-time alerts inform staff of account conditions and reinforce policy and compliance requirements

- User-defined screens: each agent work group can control their preference for borrower and account data views

- Queue assignments: dynamic real-time and nightly queue assignments based upon borrower behavior and internal account work streams

- Automated workflow: facilitate account process automation and streamline internal and external processes

- Role-based permissions: align servicing functions to accelerate decisions and facilitate process control

- Risk & compliance automation: allow configuration to guide the loan life cycle path to keep your organization compliant

- Securitization: manage, track, and report on sophisticated securitization structures

- Customer service: route, queue, and manage customer disputes and support

- Fee management: configure and deploy new fee structures to your lending products

- Payment processing: comprehensive scheduled and on-demand payment tools

- Deploy configurable collection strategies: collection strategies easily configured for your specific borrower profile

- Document management: automated customer communication correspondence tools

- Dialer integration: daily text and dialer campaigns boost outreach efforts

- Promise tracking and reporting: automated administration and tracking of PTP results

Conclusion

Shaw is a loan origination software that allows users to manage processing methods, accruals, amount withheld and amount of recourse. Users can also calculate various leasing taxes such as sales tax, property tax and income tax.

Leave a review on this program.

You may also be interested in: The Loan Navigator

| Usability: 8 /10 | Speed: 8 /10 | Features: 7.5 /10 | Support: 8 /10 | Prezzo: 7 /10 |

Review this product

By submitting this review, you are confirming that it meets the Accurate Reviews Program Guidelines. Your Privacy is important to us